When it comes to gaining knowledge of technical evaluation in buying and selling, one of the maximum crucial gears to recognize is candlestick patterns. Among these, bullish candlestick patterns are vital for identifying capacity upward actions within the price of an asset. These patterns serve as visual signs that marketplace sentiment is shifting in the direction of customers, and they’re regularly utilized by seasoned buyers to enter or go out of positions at the most opportune times. In this blog, we can explore the 4 main bullish candlestick patterns that each dealer ought to recognize.

1. The Bullish Engulfing Pattern

The Bullish Engulfing Pattern is one of the maximum diagnosed and reliable bullish candlestick patterns. This sample consists of candlesticks: a smaller bearish (red or black) candlestick accompanied by a larger bullish (green or white) candlestick that absolutely “engulfs” the previous bearish candle.

The Bullish Engulfing Pattern indicates a potential reversal of a downtrend. Traders interpret it as a shift in momentum from sellers to consumers. When this sample appears in a downtrend, it can indicate that buying strain is overwhelming promoting strain, suggesting the possibility of an upward fee circulate.

For experienced buyers, the key to successfully using this bullish candlestick sample is to look forward to affirmation. This often comes in the form of the subsequent candle closing higher than the bullish engulfing candle, signaling that the reversal is possibly to keep.

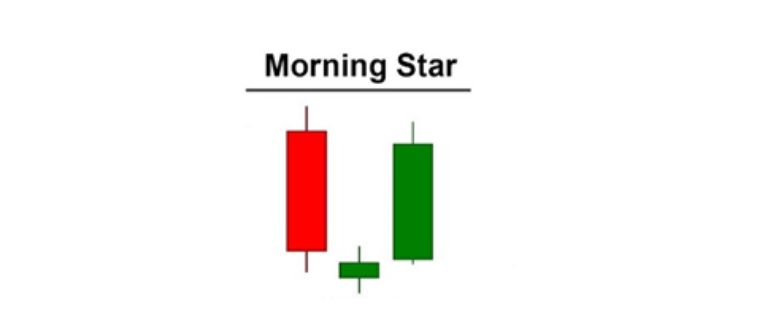

2. The Morning Star Pattern

Another effective bullish candlestick pattern is the Morning Star. It is a 3-candlestick formation that signifies the end of a downtrend and the beginning of a brand new upward circulate. The first candlestick in the sample is a long bearish candle, observed via a smaller candle (either bullish or bearish) that suggests indecision inside the market. The third and final candle is a sturdy bullish candle that closes nicely into the frame of the first bearish candle.

The Morning Star sample is regularly seen as an image of hope, indicating that shoppers are regaining manipulation after a length of selling. Traders view the Morning Star as a signal of an ability trend reversal and a strong buying possibility.

However, similar to the Bullish Engulfing Pattern, investors typically anticipate further confirmation earlier than getting into a trade primarily based on the Morning Star. A not-unusual confirmation approach is to make certain the following candle after the sample closes better than the third candle.

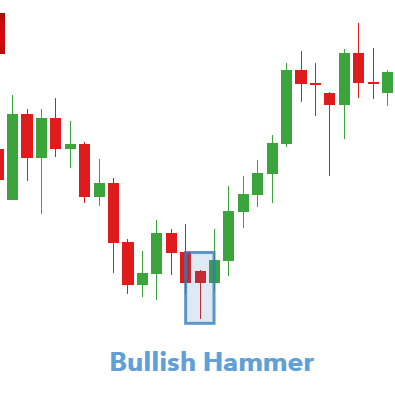

3. The Hammer Pattern

The Hammer Pattern is another normally observed bullish candlestick pattern. It consists of an unmarried candlestick that has a small body near the pinnacle, with a protracted decrease shadow. The candlestick’s shape resembles a hammer, that’s the way it was given its name.

The Hammer appears after a downtrend and indicates that the marketplace can be prepared for a reversal. The lengthy lower shadow suggests that sellers attempted to drive the price lower but were ultimately overcome with the aid of buyers who pushed the price again up, resulting in a small bullish or impartial body.

Traders use the Hammer Pattern as a signal to start looking for shopping for possibilities. To ensure reliability, it’s far essential to verify the sample with next candles, ideally expecting the subsequent candle to shut above the Hammer’s excessive.

4. The Piercing Line Pattern

The Piercing Line Pattern is another one of the main bullish candlestick patterns that traders make use of to discover a potential upward motion. This pattern is formed with the aid of candles: a protracted bearish candle observed through a bullish candle that opens beneath the low of the preceding bearish candle but closes greater than midway up into the body of the bearish candle.

The Piercing Line Pattern shows that even though sellers to start with driven the price lower, consumers regained strength, in the end using the charge higher with the aid of the near. This shift in momentum suggests a capability reversal to the upside, making it an effective sign for buyers looking to shop.

As with the other patterns, looking ahead to confirmation after identifying a Piercing Line Pattern is fundamental to decreasing the threat of fake signals. A follow-up candle that closes higher can offer the wished confirmation to enter a bullish function.

Ensure to read: Exploring the Growing World of Soccer Betting Sites: Trang Cá Cược Bóng Đá and Gobee

Tagged: Bullish candlestick patterns

Conclusion

Recognizing and understanding the 4 most important bullish candlestick patterns—the Bullish Engulfing Pattern, Morning Star Pattern, Hammer Pattern, and Piercing Line Pattern—can considerably enhance a dealer’s capacity to predict marketplace actions and make informed decisions. These patterns function as reliable indicators of potential fashion reversals and can be tremendously effective when used along with other technical evaluation tools.

As with any trading method, it’s vital to recollect that no pattern is foolproof. Always use additional strategies of affirmation and keep in mind the wider market context earlier than creating a change. By gaining enjoyment with those bullish candlestick patterns, investors can position themselves for fulfillment in navigating marketplace developments with confidence and precision.